Japan

Private Client

Introduction

Japan adopts a civil law system. Japan is a unitary state, and has only a national law. The Japanese Civil Code follows the concept of universal succession. The heirs automatically receive the ownership of the assets of the deceased and also inherit debts of the deceased (Article 896 of the Civil Code). Therefore, no probate proceeding, similar to other common law countries, exists in Japan.

1 . Tax and wealth planning

Basics of the Japanese inheritance tax

Japan imposes an inheritance tax on an heir/devisee who receives assets (i.e., the beneficiary) (Article 1-3 of the Inheritance Tax Act). Neither the estate itself nor the executor is taxed.

The basic exclusion amount (which is deducted from the amount of the total taxable assets held by the decedent to calculate the tax base) for inheritance tax is: (1) 30 million Japanese yen (JPY), plus (2) the amount obtained by multiplying JPY 6 million, by the number of legal heirs under the Japanese Civil Code (= JPY 30 million + (JPY 6 million × number of legal heirs)) (Article 15 of the Inheritance Tax Act). For example, if a husband dies leaving a wife and two children (three heirs), the basic exclusion is JPY 48 million (JPY 30 million + (JPY 6 million x 3)).

The calculation of the inheritance tax amount is complicated. The inheritance tax rate, from 10% to 55%, is applied not to the decedent’s estate as a whole but to the amount each heir assumptively receives pursuant to their intestacy share under the Japanese Civil Code (Article 16 of the Inheritance Tax Act). For example, 55% is applied if assets which an heir assumptively receives pursuant to their intestacy share is over JPY 600 million. The objective behind this method is to calculate the total inheritance tax, regardless of how assets are actually divided by the heirs/devisees.

1.1. National legislative and regulatory developments

Recent legislative developments (2018 and 2021 Tax Reform)

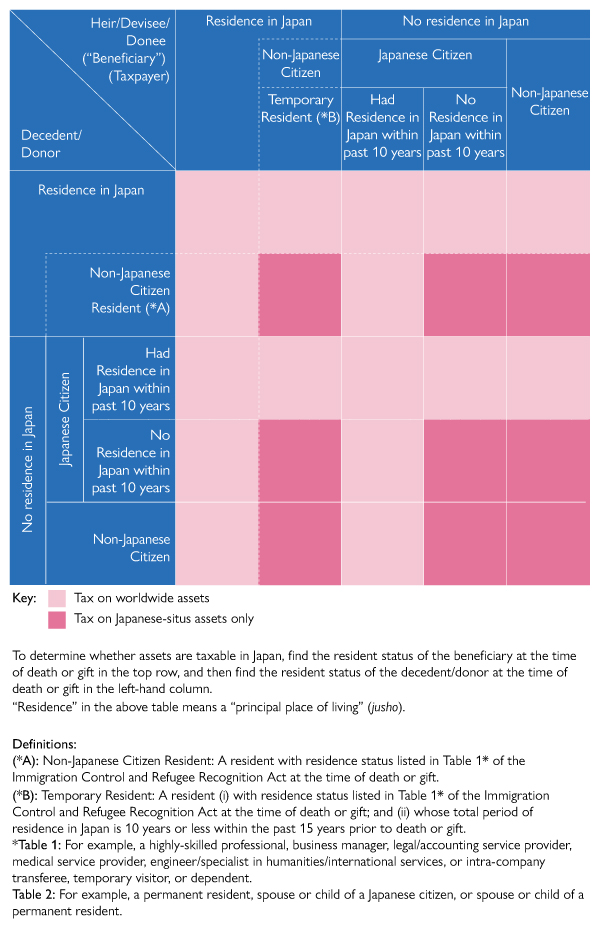

Because of the beneficiary-based tax in Japan, a beneficiary who is a resident of Japan is subject to Japanese taxation on worldwide assets (Article 1-3, Paragraph 1 (1) and Article 2, Paragraph 1 of the Inheritance Tax Act). The legal residency for inheritance tax purposes is the “principal place of living” under Article 22 of the Civil Code. It is determined by objective factors such as the length of the person’s stay, the person’s occupation, the location of the person’s spouse and other family members and the person’s assets/property.

A beneficiary who is a non-resident of Japan can also be subject to the same worldwide taxation (excluding the case where the decedent falls within certain exceptions), to prevent tax avoidance (Article 1-3, Paragraph 1 (2) and Article 2, Paragraph 1 of the Inheritance Tax Act).

Since wealthy Japanese individuals have tried to avoid taxes by having a beneficiary reside outside Japan and transferring their assets overseas, the Japanese tax agency has been expanding the scope of the taxes on overseas assets under the 2000, 2013 and 2017 Tax Reforms. The 2017 Tax Reform, however, widened the scope of worldwide taxation too much by taxing non-Japanese citizens who left Japan with respect to their non-Japanese assets inherited by non-Japanese citizens who are non-residents of Japan. In order to encourage highly skilled non-Japanese citizens to come to work in Japan and to transform Japan into a global financial city, the 2018 and 2021 Tax Reforms provided them relief.

Under the 2018 Tax Reform, after non-Japanese citizens leave Japan, their overseas assets will no longer be subject to Japanese inheritance tax (excluding the case where the beneficiary is subject to worldwide taxation).

Further, under the 2021 Tax Reform, the requirement of a limited stay (10 years or less within the past 15 years) for a decedent who is a non-Japanese citizen but resident in Japan in order to avoid worldwide taxation was abolished. If the decedent is a non-Japanese citizen residing in Japan with a Table 1 visa under the Immigration Control and Refugee Recognition Act (Act), such as a work visa, at the time of his death, even if he has resided in Japan for more than 10 years, his overseas assets will not be subject to Japanese inheritance tax (excluding the case where the beneficiary is subject to worldwide taxation).

Scope of Japanese Inheritance and Gift Taxation (after the 2021 Reform)

Please note, however, that the requirement of a limited stay (10 years or less within the past 15 years) for a beneficiary who is a non-Japanese citizen but resident in Japan with the Table 1 visa in order to avoid worldwide taxation remains. If a beneficiary is a non-Japanese citizen residing in Japan for more than 10 years, even if they stay in Japan with the Table 1 visa, the worldwide assets which they inherit (from US-based parents, for example) will be subject to the Japanese inheritance tax.

1.2. Local legislative and regulatory developments

Not applicable, because Japan has only a national law.

1.3. National case law developments

Not applicable, because Japan has adopted a civil law system and codified statutes predominate.

1.5. Practice trends

The type of visa held by non-Japanese would have an impact on Japanese inheritance and gift tax.

Some of non-Japanese citizens residing in Japan choose a Table 1 visa such as a work visa rather than a Table 2 visa such as a spouse visa, because, in some cases, they can avoid worldwide taxation of the Japanese inheritance and gift tax.

2 . Estate and trust administration

2.1. National legislative and regulatory developments

National legislative developments in inheritance law

2018 Amendment of Civil Code (Inheritance Law)

The inheritance law chapter of the Civil Code (Code) was amended in July 2018 for the first time in 38 years, most of which took effect in July 2019. Since Japan is aging fast, the amendment aims to protect elderly widows and widowers, and to encourage people making wills.

- Creation of spousal right to live in an inherited residence. The amendment created the right for a widow or widower (hereinafter “widow”) to continue living in an inherited residence. When a widow has lived in a home that belonged to her deceased spouse at the time of the spouse’s death, the widow will have the right to keep living there for free, if the spouse has devised such a right to the widow in his will, or if the right is given pursuant to the estate division agreement among all of the heirs (or a court order) (Article 1028, Paragraph 1 of the Code). This right lasts until the widow dies, but can end sooner than that (Article 1030 of the Code). By registering this right in the real property registry, the widow can claim her right against a third party (Article 1031, Paragraph 1 of the Code).

- Relaxing the requirement of a holographic will. The forms of the wills under the Code includes a holographic will. The testator must handwrite the entire text, the date and their name and affix their seal. It could be difficult for the testator to handwrite the details of assets. To make it easier for the testator to make a holographic will, the amendment enabled the testator to attach a list of assets not handwritten to their holographic will. The testator must sign and affix their seal on each page of the list in order to prevent forgery (Article 968, Paragraphs 1 and 2 of the Code).

- Creation of governmental system to safekeep a holographic will. A new law, the Act on Storage of Wills in the Legal Affairs Bureau, was enacted in 2018, and the Legal Affairs Bureau has started to safekeep originals of holographic wills since July 10, 2020. The testator must bring the original of their holographic will and visit the Legal Affairs Bureau in person. A lack of deposit does not impact the validity of the holographic will, but if a holographic will is deposited with the Legal Affairs Bureau, there will be no need of the will’s procedure named kennin in family court after the testator’s death.

- Right to legally reserved portion as monetary claim. A certain portion of the estate is reserved for certain heirs. Eligible heirs are the spouse, descendants (including adults) and ascendants, but not siblings (Article 1042 of the Code). The legally reserved portion is generally one-half of the decedent’s estate. Certain lifetime gifts (evaluated as of death) are added to the estate (Article 1029, Paragraph 1 of the Code). For example, assuming that a Japanese citizen dies leaving his wife and two children, each legally reserved portion of the heir is: wife, 1/4 (=1/2 ×her intestacy share of 1/2); each child, 1/8 (=1/2 ×each child’s intestacy share of 1/4). Under the old law, a will becomes void to the extent it infringes a claimant’s legally reserved portion when an heir claims their right. This often makes business succession difficult. To ensure the testator’s testamentary freedom, the amendment changed the right to the legally reserved portion into a monetary claim against the devisee (Article 1046 of the Code). A will remains valid even after an heir claims their right.

National legislative developments in trust law

2006 Amendment of Trust Act

Trusts were incorporated in Japan in the 1900s, and Japan has had a codified law of trusts since 1922. In Japan, trusts developed primarily through trust banks in the area of commercial trusts, particularly since the end of World War Ⅱ. Since Japan is a fast-aging country, increasingly, needs have appeared in the area of family trusts for guardianship-substitute and will-substitute purposes. Accordingly, to meet the new demands, an amended Trust Act was enacted in 2006, which substantially amended the old Trust Act. It includes several improvements to facilitate the use of trusts for family or succession purposes, but the taxation of trusts, which takes a hostile view of trusts for estate planning, sometimes discourages people from using such trusts.

2004 Amendment of Trust Business Act

There has been a license requirement to engage in a trust business since 1922. Since all the trust companies had merged with ordinary banks to form trust banks by 1948, only trust banks have served as trustees in Japan until 2004. To meet the demands of the times, mainly in the area of commercial trusts, an amended Trust Business Act was enacted in 2004, allowing certain trust companies other than trust banks to engage in the trust business. For family or succession purposes, however, there are only a few trust companies which offer services. An attorney cannot become a trustee as a professional, since professionals providing trust services must be a joint stock company licensed by, or registered with, the Prime Minister of Japan (Articles 3 and 2 (Paragraphs 1 and 2) and Articles 5 and 7 of the Trust Business Act).

2.2. Local legislative and regulatory developments

Not applicable, because Japan has only a national law.

2.3. National case law developments

Not applicable, because Japan has adopted a civil law system, and codified statutes predominate.

2.5. Practice trends

Execution of the will made easier

The amendment of the Civil Code to change an heir’s right to the legally reserved portion into a monetary claim against a devisee has made the execution of the will easier. Even if an heir claims their right, the will remains valid, and therefore the executor no longer needs to worry about whether to stop the execution of the will. Still, a trust bank, often designated as executor of a will in Japan, would be nervous about being involved in a family dispute over the legally reserved portion, and thus encourages the testator to make a will not infringing such heir’s right by devising certain assets to all the eligible heirs.

Practice of family trusts in Japan

Recently more people who own real properties have set up a trust for real properties to avoid a guardian appointed by a court and to let a family member as a trustee manage the real properties before/during the owner’s mental incapacity. It is possible to change the owner’s name into the trustee’s name in the real property registry.

In contrast, regarding financial assets in Japan, it is practically very difficult to find a financial institution, including a bank, in Japan which will let a trustee open a trust account under the name of the trustee of a trust, even if it is a Japanese trust. Therefore, even if trusts can be legally created in Japan, it will be practically easier for a US citizen to transfer funds and stocks from their accounts in Japan to accounts under the name of the trustee of their US revocable trust in the US.

3 . Estate and trust litigation and controversy

3.1. National legislative and regulatory developments

The 2011 Amendment of Code of Civil Procedure (CCP) added provisions regarding jurisdiction of courts in Japan for international cases including the following:

- For a lawsuit against an individual, Japanese courts will have jurisdiction if the defendant resides in Japan (Article 3-2 of CCP).

- For a lawsuit regarding inheritance rights, legally reserved portion, or bequests and other acts which will have effect by reason of death, Japanese courts will have jurisdiction if the decedent resided in Japan at the time of his death (Article 3-3, Item 12 of CCP).

3.2. Local legislative and regulatory developments

Not applicable, because Japan has only a national law.

3.3. National case law developments

Please note that Japan has adopted a civil law system, and codified statutes predominate.

Recent district court decisions include the following:

- Japanese courts will apply the legally reserved portion rules to the worldwide assets as well as the Japanese-situs assets. A Tokyo District Court Decision dated March 28, 2007 included a decedent’s overseas assets such as a Cayman trust, joint accounts in the United States and a condominium in California among the basic assets to calculate the amount of the legally reserved portion.

- A Tokyo District Court Decision dated September 12, 2018 invalided a trust agreement between a decedent and his second son as trustee, because it was made to avoid another heir’s right to the legally reserved portion and thus against the public policy of Japan.

3.5. Practice trends

A Japanese Notarial Deed Will is recommended. One reason is that an heir can challenge a will in Japan based on the decedent’s mental capacity, but it is practically difficult to win a judgement invalidating a Japanese Notarial Deed Will, even with evidence of a testator’s medical records at the time when the testator made the will.

The Japanese Notarial Deed Will is prepared by a notary who is a retired judge or prosecutor, and therefore, a credible person from a judge’s perspective, and the notary tends to assert or testify in front of the judge that the testator had mental capacity. The notary does so because, if the will he prepared is declared invalid, it will disgrace the notary.

3.6. Pandemic related developments

The 2022 Amendment of Code of Civil Procedure was enacted in May 2022, which will take effect in 4 years, aimed at making civil court procedures online. Currently, a written complaint to file a lawsuit and a written brief need to be brought or sent to the court, but the amended law will allow such documents to be submitted online (“e-Filing”). Hearings and witness examinations now need to be held in a court room, but can be carried out in the form of online conferences under the amended law (“e-Court”). Plaintiffs, defendants and their attorneys will thus be able to complete procedures without visiting a court. Court decisions and other records are now kept in paper form at the court, but will be digitized and made available to be viewed and downloaded by involved parties through the internet (“e-Case Management”).

4 . Frequently asked questions

When can a client avoid Japanese inheritance tax on their US-situs assets?

Here is the outline of the 2021 rule from the standpoint of a decedent:

- Japanese Citizen. Suppose the client is a Japanese citizen. The advice would be to stay alive (if possible) more than 10 years after leaving Japan. A beneficiary who is a Japanese citizen also needs to meet the same requirement.

- Foreign Resident. Suppose the client is a US citizen living and working in Japan. In this case their type of visa would matter. If they reside in Japan with a Table 1 visa under the Act (such as a work visa) at the time of death, Japanese worldwide taxation may not apply to the estate, depending on the status of the beneficiary. In contrast, if the client resides in Japan with a Table 2 visa under the Act (such as a spouse visa) at the time of death, Japanese worldwide taxation will apply to the estate, regardless of the status of the beneficiary. Any spouse can, however, claim the spousal credit.

- Foreigners Who Have Left Japan. Suppose the client is a US citizen with a US spouse who has resided in Japan for more than 10 years and will leave Japan to return to their home country. If they leave Japan, the client’s US assets inherited by the US spouse will not be subject to Japanese inheritance tax. In contrast, if they have a Japanese spouse, assets inherited by them will remain subject to the Japanese inheritance tax for 10 years after the spouse leaves Japan.

3-6 PQE Corporate M&A Associate

Job location: London

Projects/Energy Associate

Job location: London

3 PQE Banking and Finance Associate, Jersey

Job location: Jersey

Tomoko Nakada

Tomoko Nakada