Sign up for our free daily newsletter

YOUR PRIVACY - PLEASE READ CAREFULLY DATA PROTECTION STATEMENT

Below we explain how we will communicate with you. We set out how we use your data in our Privacy Policy.

Global City Media, and its associated brands will use the lawful basis of legitimate interests to use

the

contact details you have supplied to contact you regarding our publications, events, training,

reader

research, and other relevant information. We will always give you the option to opt out of our

marketing.

By clicking submit, you confirm that you understand and accept the Terms & Conditions and Privacy Policy

Macfarlanes has secured a second investment funds specialist from Sidley Austin in London this year as the City’s private equity and funds lateral hiring market continues to buzz.

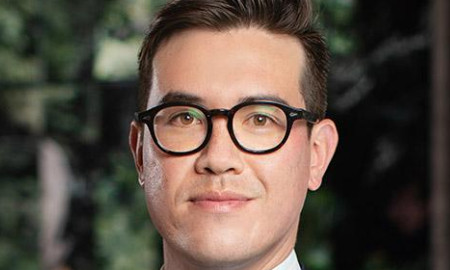

Peter Chapman has joined the firm’s investment management group as a partner today after 11 years at Sidley, where he trained and was most recently a senior associate. The group is led by partner Stephen Ross, who himself joined Macfarlanes at the start of this year from Sidley Austin.

For his part Chapman advises private fund sponsors across a range of asset classes including private credit, private equity, growth capital, venture capital and hedge funds. As well as fund formation and management structuring, Chapman has experience working on GP-stake deals and secondaries transactions. He also advises major institutional investors on their private fund allocations, co-investments and LP portfolio sales.

Macfarlanes senior partner Sebastian Prichard Jones described Chapman as “a highly talented practitioner”, adding that his fund structuring expertise “would strengthen our private capital offering and its place at the core of our firm.”

The firm’s investment management group is noted by Chambers for its work advising UK managers looking to raise mid-market buyout funds, with a team that includes regulatory experts and fully integrated tax specialists. Alongside Ross, key partners include hedge fund group head Samuel Brooks and Lora Froud, who led the Macfarlanes team that advised on the launch of FP Octopus UK Future Generations Fund, a fund operated by FundRock Partners and managed by Octopus Investments, in 2021.

Macfarlanes saw its revenue and profits slide in the 2023 financial year after a barnstorming 2022, when a record deals market powered the firm’s profits per equity partner (PEP) up nearly 20% to just shy of £2.5m against a 16.4% rise in revenue to £303.7m.

In contrast PEP dropped to £2.1m in FY23, when a number of UK firms recorded flat or falling profits against a background of inflation and rising costs, while turnover dipped to £296.6m.

The firm promoted eight lawyers to partner in May across its real estate, finance, commercial, litigation and dispute resolution, private client, corporate and M&A, and tax and reward teams.

In July, Sidley lost highly rated funds partner Mateja Maher and senior associate Adrian Grocock to Latham & Watkins, with Maher joining as a partner. However, a month before that it secured two partners from Paul Weiss Rifkind Wharton & Garrison to bolster its global M&A and private equity practice, including Ramy Wahbeh, who joined as co-leader of the firm’s global private equity practice.

Those hires preceded Paul Weiss’s explosive four-partner raid on Kirkland & Ellis in London, led by private equity debt finance specialist “superstar” Neel Sachdev, which dominated legal press headlines during August.

Email your news and story ideas to: [email protected]